Why Equalizer?

Uniswap describes a vision of a fair decentralized trading protocol: on the one hand, anyone can exchange two paired tokens anytime and anywhere; and on the other hand, it uses fair incentives to encourage everyone to provide liquidity for trading. All records are recorded in the chain and are immutable. Uniswap has been working hard to implement this vision. The recent emergence of UNI, which is Uniswap’s governance token, should have provided greater impetus to this vision, however, has harmed the fairness of the entire system in real practices. At present, UNI’s token incentive mechanism is only for four trading pairs. In order to obtain the governance token, more liquidity floods into these four trading pairs, but the LP of other trading pairs cannot get incentives UNI token no matter how much they contribute.

The same problem is more obvious on SushiSwap. At present, SushiSwap has 100 trading pairs, but only the liquidity providers (LPs) of 18 trading pairs can get the governance token Sushi as a motivation. These 18 trading pairs accounted for more than 90% of the liquidity on SushiSwap, while other trading pairs without incentives have almost 0 trading volume.

Chart: top trading pairs in Sushiswap by volume

Obviously, under such a governance token distribution model, the trading pairs that get incentives for governance token can get more attention and liquidity. Not only Uniswap and SushiSwap but all swap projects on the current market are subjected to a one-time decision by the development team which trading pairs can obtain governance token liquidity mining incentives and the corresponding mining weights. Even if the trading pairs and weights can be modified through community voting later, the whole process is inflexible and slow with a long time waiting. Such a governance token distribution mechanism loses the decentralization, which is the real meaning of DeFi, and runs opposite with “universal swapping”. Therefore, we hope the incentives to return back to the free distribution of the market from artificial decisions, also, we aim to achieve an equal and efficient governance token distribution mechanism.

Our Design

Learned from the development experiences of the previous projects, and combined our own understanding of the DeFi industry, we will launch Equalizer — on the basis of having the mainstream functions of DEX, we added major innovations that maximize value capturing of governance tokens with equal and self-adjusting token distribution.

Governance Token — EQL

EQL is the governance token of Equalizer, which is used for decentralized governance of future projects and asset liquidity incentives.

The trading fee ratio is initially set at 0.3%, of which 0.15% will be allocated to LP, and 0.15% will be used to buy back EQL and burn. When the daily buyback amount is greater than the new daily-generated EQL amount, the entire system will become a deflationary mode.

Although the trading fees received by LP have been reduced, the governance token income obtained through liquidity mining is expected to be higher (the governance token captures greater value). On the whole, not only there is no loss, but the overall gain may be greater.

1. Trading pairs can be added freely, and the governance token will be distributed intelligently by the activities, without subjective distributions by the team.

Equalizer’s system adopts a unique liquidity mining mechanism, in which governance tokens will be distributed intelligently by the trading volume. The system will adjust the weight of each trading pair on the EQL liquidity mining pool automatically every 8 hours(the frequency can be adjusted by community voting later). Anyone can add new trading pairs at any time, and the trading pair can have the weight of EQL for its trading volume. The new weight is related to the amount of EQL buyback and burn by each trading pair in the previous rounds. The greater the number of EQL buyback and burned, the higher the weight of the trading pair on EQL liquidity mining pool, i.e., the more active trading pairs are, the more rewards they can get, forming a positive feedback mechanism.

In order to avoid skyrocketing and plummeting trading volume under some extreme circumstances, and to reflect the real market popularity by liquidity, we introduced the EMA (Exponential Moving Average) mechanism, which calculates the value based on the existing and historical trading data.

For a simplified example:

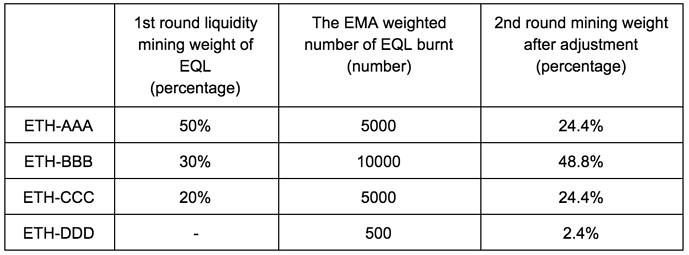

Assuming there are three trading pairs and no new trading pairs are added, the second round of weight adjustment is shown as follows (The data is for reference only.):

If a new trading pair ETH/DDD is added. The weight of the first round of mining is 0, but because the transaction volume is growing rapidly and the number of EQL buyback and burn is large enough, the corresponding EQL mining weight will be increased in the second round for this trading pair. (The data is for reference only. The optimization effect of the curve cannot be reflected due to the time limitation)

Only on the first day of launching, we will pre-designate 10 trading pairs and the corresponding liquidity mining weights. After that, anyone can add new trading pairs at any time, the mining weight of all the other trading pairs will be automatically adjusted every 8 hours, according to the number of EQL buyback and burned based on the trading volume (the adjustment interval can be changed by governance voting, and users can also burn EQL directly to gain more weight of a pair).

2. Other innovative design — Use a DeFi-optimized token economics

In order to better encourage early liquidity providers, and have enough tokens to incentivize the long-term development of the ecosystem at the same time, we have developed a quasi-fixed-supply (QFS) distribution model. Similar to the standard periodic reduction model, this model will halve the emissions after each production cycle (a.k.a., epoch). But the difference compared with the standard reduction model is, the new epoch time will be twice as long as the previous epoch. To illustrate the advantages of our distribution model, we draw a comparison chart of our model and others in terms of emission rate and total supply over time. From the charts, our distribution model allows early liquidity providers to enjoy the incentives brought by the halving. Meanwhile, compared to the standard reduction model, doubling the duration of a new epoch can also better support future participants. In addition, compared with the constant emission model (such as SushiSwap), the reduced emission design could alleviate the concern about the value dilution caused by future issuance.

Initial trading pairs and weights (in the units of EQL) are listed as follows:

- ETH-EQL (3x), 3000 EQL

- ETH-UNI, 1000 EQL

- ETH-SNX, 1000 EQL

- ETH-QKC, 1000 EQL

- ETH-YFI, 1000 EQL

- ETH-USDT, 1000 EQL

- ETH-LINK, 1000 EQL

- ETH-COMP, 1000 EQL

ETH-EQL trading pair will have 3x liquidity mining reward compared with other trading pairs. The weights will be automatically adjusted for every 8 hours, and the initial decay parameter for EMA is 0.75.

Token Distribution

0 Pre-mined, no private sale and no public sale

The 10% of liquidity mining on EQL is set aside for auditing, developers, and future employees, among which 1% mined in the 1st month will be donated to the Uniswap team for the appreciation of their contribution to DeFi and promote healthier development of DeFi with a better mutual benefit mechanism among projects, rather than simple malicious plagiarism and forks.

When Equalizer is launched, we will use the following parameters to start our QFS distribution model:

- The first epoch is at 20,000 blocks (about 3.5 days)

- The first epoch will produce 10 EQL per block

That is to say, 200,000 EQLs will be mined in the first 3 days, and then 200,000 EQLs will be mined in the following 7 days, and then 200,000 EQLs will be mined in the following 14 days, and so on.

Development Plan

Phase I

The current smart contract code of Equalizer is under auditing. We plan to launch the first version of Equalizer, including DEX and EMA-based dynamic governance distribution, on Ethereum in about one week (please pay close attention to our social channels for the exact launch date: Twitter/Telegram).

Phase II

Next, we will constantly improve Equalizer, including introducing DAO governance.

Phase III

The next important goal is to solve the gas fee and performance issues of the network. We plan to use other high-performance public chains (such as QuarkChain) and cross-chain solutions to address ETH throughput issues. Relying on the high performance and low cost of QuarkChain’s mainnet, the use value of Equalizer can be increased. Furthermore, the tokens on Equalizer can be native-tokenized, which can be used to pay the gas fee and calling smart contracts directly without pre-authorization steps

About Us

Equalizer was led by the co-founder of the QPocket team, Mr. Johnny Chu. All the engineers in the team come from top-notch IT companies such as Google, Microsoft, Adobe, etc., with extensive experience in blockchain development.

Qi Zhou, founder of QuarkChain, helps design the innovative token economics model and core code. Moreover, he provides full support in the engineering side as one of our advisors.

Code Audit

The code is under auditing by a professional audit company right now, a fully audit report will be published before Equalizer is launched.

Join us

Website: equalizer.fi

Telegram: https://t.me/equalizer_fi

Twitter: https://twitter.com/Equalizer_Fi